Find out more about who is investing for impact.

2022 Investor Survey Release

July 27, 2022

Every two years, we conduct a survey to better understand both our current investor base as well as the broader impact investing community—who they are, what motivates them, and what challenges they may be facing. We use the results of this survey internally to guide our work and we release the data publicly in the hopes that it is useful to the impact investing industry writ large.

We launched the survey in February this year, nearly two years after the start of the COVID-19 pandemic, as the world continues to adjust. We were particularly interested to see how investors’ and advisors’ attitudes towards impact investing may have changed in those two years and what actions they had taken since the start of the pandemic. Nearly 800 people responded to the survey, providing key insights into investors’ interests. Based on what we heard, our diverse investor base continues to grow and there is more interest in impact investing now than ever before.

For more information on our investors download the Investor Infographic and read our key insights below. And stay tuned as we’ll be sharing more insights from the survey over the coming weeks.

1. The Community Investment Note® is a gateway to impact.

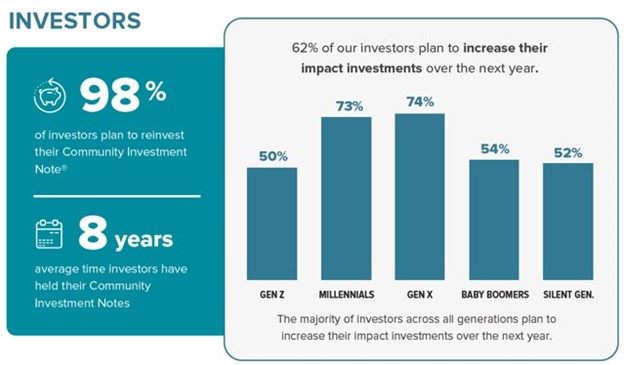

Investors continue to rely on the Community Investment Note® as a gateway product to impact investing. 54% of investors stated the Note was their first cause-based or impact investment (up from 47% in 2020) and 38% stated the Note is their only impact investment (down from 40% in 2020). 62% of investors intend to increase their impact investments over the next year, a strong indicator for increased momentum in the industry.

Our investors hold their Notes for an average of 8 years and 98% of investors stated they would consider investing with us in the future – meaning that they see the value of reinvesting in the Note and in our mission to channel capital to communities and create a more equitable and sustainable world.

2. Investors are motivated to mitigate climate change, address gender and racial inequities, and create opportunity.

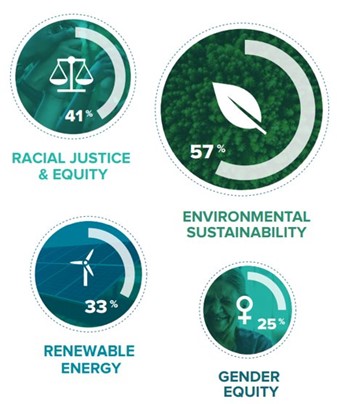

When asked to choose the top three issue areas that they care most about, investors most commonly chose environmental sustainability. Since our 2016 survey, environmental sustainability has been rated as the #1 issue in nearly every demographic group. Renewable energy was also rated a top issue by 33% of investors (an increase of 7% from 2020). Additionally, 67% of investors explicitly responded that they invest “to positively influence climate change” (up 5% from 2020).

Our investors also care deeply about racial justice and equity, as well as gender equity and women’s empowerment. 41% of our investors indicate racial justice and equity is a top concern (an increase of 5% since 2020), and 48% of investors reported having made new investments intended to positively impact racial equity and justice since the start of 2020.

3. Financial advisors are eager to make more impact investments on behalf of their clients.

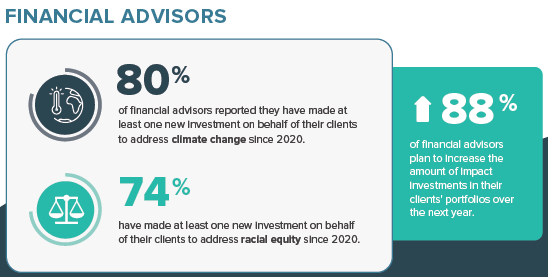

Whether it’s to address climate change or racial equity, the vast majority of financial advisor respondents reported having made at least one new impact investment since 2020, and 88% of advisors plan to increase the amount of those investments in their clients’ portfolios over the next year.

94% of financial advisors reported interest in seeing more impact investing products in the market, across both public and private markets as well as multiple asset classes and risk profiles. When asked about barriers, ease of purchase was highlighted as the top challenge, a sentiment echoed by non-advisor respondents. As the industry continues to grow and more accessible products are created, our survey data suggests ever increasing demand for impact investing and momentum towards acting upon that demand.

4. Our investors are diverse across age, gender, wealth, and income.

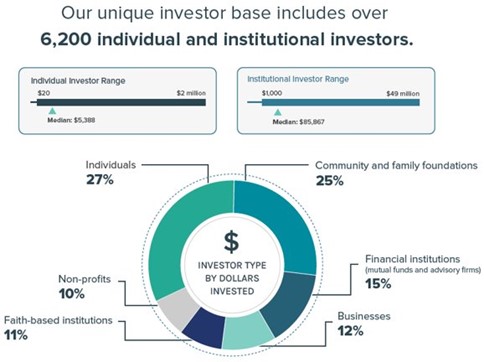

Our investors are a diverse group – retail investors that range from the impact investing newcomer who made their first $20 impact investment to the veteran impact investor who manages their entire portfolio with impact strategies; and our institutional investors that range from financial institutions to foundations, faith-based institutions, and other nonprofits.

Our individual investors make up 98% of our investor base, and live across all 50 US states plus DC, Puerto Rico, and the US Virgin Islands. They span a range of income levels and generations, from the Silent Generation all the way to Generation Z, including those just starting their careers and building their investment portfolios to those about to retire with a robust investment portfolio. Over half (53%) of our investor survey respondents were women.

Check out the full Investor Infographic for a more detailed breakdown of who these investors are.