Calvert Impact Capital CEO Jenn Pryce with IFC CEO Philippe Le Houerou Photo © Dominic Chavez/International Finance Corporation

Our first Impact Management Disclosure

March 31, 2020

Calvert Impact Capital is a founding Signatory to the Operating Principles for Impact Management (the Principles), a set of impact management best practices designed to promote impact integrity and increase transparency in reporting. The Principles aim to provide a common market standard to evaluate an asset manager’s impact management processes. To-date, over 90 leading global impact investors have adopted them.

The Principles are not only focused on standardization, but on transparency and integrity. They mandate an annual Disclosure Statement and periodic verifications to ensure that investors are truthfully disclosing their practices. Calvert Impact Capital is pleased to release its first inaugural Disclosure Statement and Verification Statement – the second Signatory to release both.

Amid a rapidly changing global environment, we believe that increased clarity around impact measurement and management remains critical. The Principles are essential to creating a foundation for growth in any environment, ensuring that impact investing can reach the scale demanded of it by our global challenges.

What are the Principles?

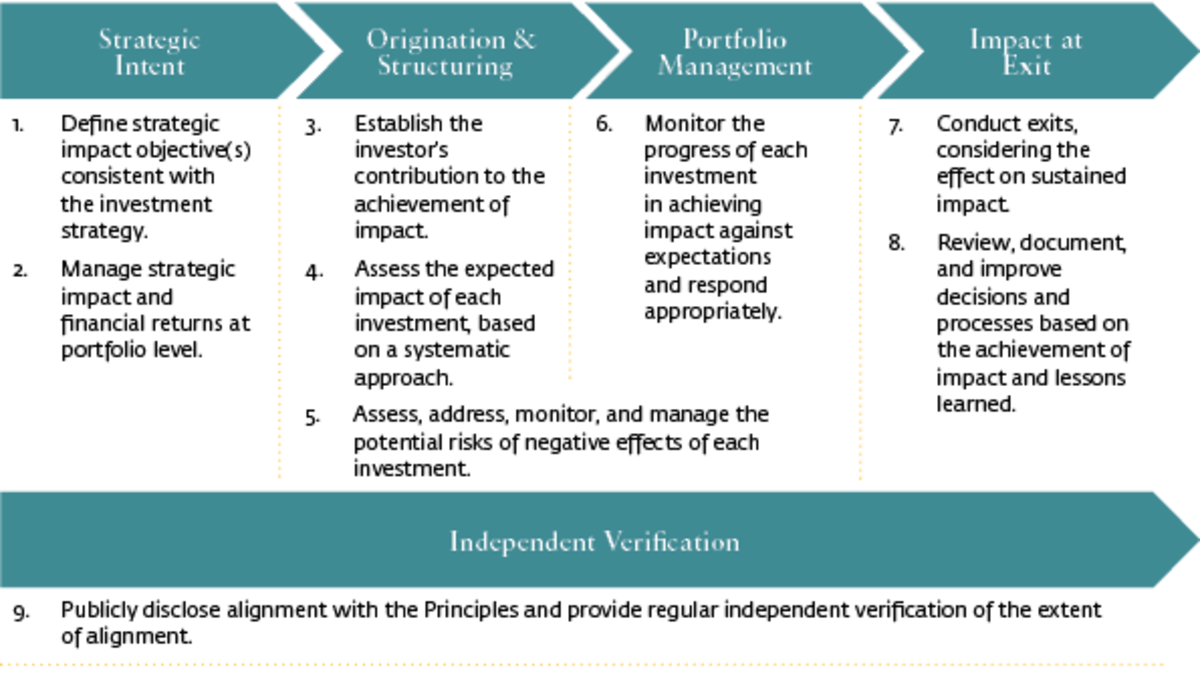

The Principles do not stipulate what impact is, but provide a standardized framework to evaluate how different asset managers incorporate impact in their practices. Signatories commit to integrating impact management best practice throughout the entire investment lifecycle, from strategy to deal sourcing to exit or repayment, and ensure that lessons learned are continuously incorporated into portfolio management.

While Calvert Impact Capital has always provided comprehensive impact reporting, by adopting these Principles, we committed to publicly disclosing the details of our impact measurement and management (IMM) practices in alignment to the Principles framework.

Why are the Principles important?

The Principles are important because they seek to provide a standard framework and clarity that investors need to understand and compare impact management practices across asset managers. When impact management disclosure becomes best practice, firms with robust impact management practices should be preferred. Investors will have more validated and trusted tools at their disposal to evaluate impact investment options, facilitating greater investor understanding of and participation in impact investing. Only by engaging more investors can we, as an industry, step up to the challenge posed by the Sustainable Development Goals—a challenge made even more critical to address given the current global environment.

What does Disclosure and Verification mean?

We are proud to become the second Signatory to release both a disclosure statement and verification statement as required by Principle 9. To-date, six other Signatories have released disclosure statements. We engaged Tideline Verification Services, a subsidiary of Tideline Advisors, a woman-owned impact investing advisory firm, to conduct the inaugural verification of our impact management system. Tideline’s verification statement is included at the end of the disclosure statement.

Our disclosure statement and Tideline’s verification statement validates that:

-

Calvert Impact Capital is built to create positive impact, as demonstrated by our strategy, our portfolio, and our policies and procedures;

-

Our impact management practices are advanced in understanding our positive Community Impact, as well as our contribution to the market through our Investor Impact and Portfolio Impact;[1]

-

We take an active learning approach that identifies best-in-class practices and incorporates these new standards into our work.

We have made the decision to release the results of the verification, including Tideline’s assessment of the degree to which our IMM practices align with the Principles as well as Tideline’s recommendations for improvement. Even though Principle 9 only mandates that a Signatory include a verifier’s statement, we felt it necessary to release the details of our alignment to the Principles, in the aim of transparency in investor disclosure. We hope that the rest of the industry will follow suit.

Thoughts or feedback on our Disclosure and Verification? Contact me at impact@calvertimpactcapital.org.

For more:

Read our Disclosure Statement and Tideline’s Verification Statement.

See our recently released Audited Financial Statements for the year ended December 31, 2019.

To learn more about the Principles and the importance of verification, watch a recently recorded panel on Impact Through Assurance, moderated by Tideline and hosted by The Rockefeller Foundation, featuring Caitlin Rosser and fellow panelists from the International Finance Corporation, Prudential, and UN Principles for Responsible Investment.

[1] Two layers of impact we assess; see the Disclosure for additional information.